how to open tax file malaysia

Once that is done click on Download Form E sign and submit via E-Filing. Recovery of sales tax before payable from persons about to leave Malaysia 31.

E Filing File Your Malaysia Income Tax Online Imoney

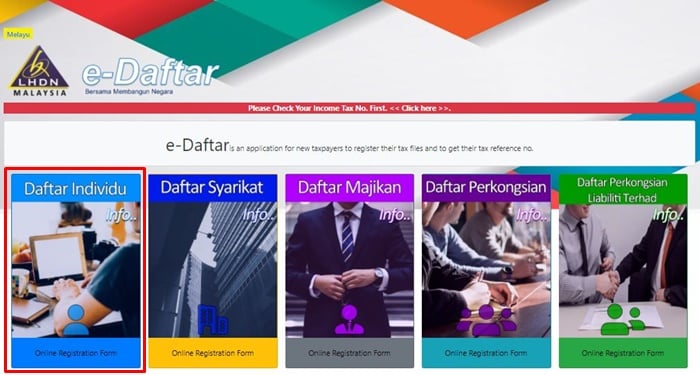

If you are newly taxable you must register an income tax reference number.

. First of all you need to register at the ezHASiL e-Filing website. Remember you need to register as taxpayers while registering for ezHASiL e-Filing. Https Ez Hasil Gov My Ci Panduan Latest Panduanci Eborang E 20v3 3 Pdf.

A businessperson with taxable income. Fill in the required information. How to Register a tax file in Malaysia.

The process of registration is discussed below. Make sure your email address is correct because LHDN will send a reference number to your email. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing.

Fill up PIN Number and MyKad Number click Submit button. Malaysia Personal Income Tax Guide 2020 Ya 2019. In-person registration is available at any Inland Revenue Board of Malaysia office or Urban Transformation Centre UTC branch.

You must be wondering how to start filing income tax for the. You can register your tax file online. A list of offices and branches where you can register is available on the Inland Revenue Board of Malaysia website.

Double-check each employees Borang E to ensure that everything is in place. Chargeable person under section 30a of the petroleum income tax act 1967 exploration and section 30 of the petroleum income tax act 1967. An employee who is subject to monthly tax deduction.

Review all the information click Agree Submit button. Greetings from deloitte malaysia tax services deloitte malaysia inland revenue board of malaysia takeaways. Any individual earning a minimum of rm34000 after epf deductions must register a tax file.

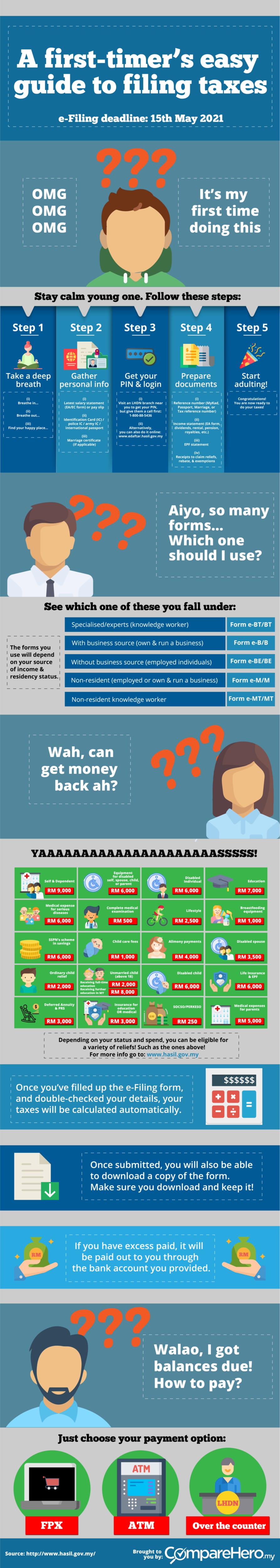

How to File Income Tax in Malaysia 2021 LHDNAre you filing your income tax for the first time. Fill up this form with your employment details. Goods subject to customs or excise control not to be.

A business or company which has employees and fulfilling the criteria of registering employer tax. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days. Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the.

We have prepared a primer and a simplified step-by-step guide based on our own experiences to help you understand what you need to do and how to file your pe. Click on Generate Form E for 2020. A subsidiary in Malaysia will be treated as a local company from a tax point of view.

The following entities and accounting firms in Malaysia must file their taxes. Thus those who want to open a company in Malaysia as a subsidiary have to file financial documents with the Companies Commission of Malaysia and need to conduct an yearly audit on the companys accounts. Lanjutan daripada itu pengeluaran STOKC juga akan diberhentikan.

Bring along your supporting documents. Head over to Payroll Payroll Settings Form E. 3 File name must only contain Alphanumeric Characters a-z A-Z and 0-9.

Payment by instalments 33. Recovery of sales tax etc from persons about to leave Malaysia without paying sales tax etc. Unregistered companies with IRBM.

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today. Taxpayers are advised to submit their.

Registering as a business for more tax incentives. In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal. The same is applicable for its reporting requirements.

Browse to ezHASiL e-Filing website and click First Time Login. An e-Daftar application will be cancelled if complete documents are not received within 14 days from the date of application and an applicant must make a new. Power to collect sales tax etc from person owing money to taxable person 30.

At the IRB office ask for the form to register a tax file. Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. Register at the nearest IRBM Inland Revenue Board of MalaysiaLHDN Lembaga Hasil Dalam Negeri branch OR register online at hasilgovmy.

Now income tax registration is much easier than before. It may be a good idea to register your freelance work as a business with Suruhanjaya Syarikat Malaysia SSM even if you are only freelancing as a side gig. Provide copies of the following documents.

Untuk makluman STOKC adalah pengesahan yang dikeluarkan oleh LHDNM ke atas status seseorang yang dikenakan cukai di Malaysia. With Talenox Payroll you can submit Borang E in just 3 steps. This is because it opens up a number of tax deductions allocated specifically for businesses.

2Only gif File Format is allowed and the file size must be from 40k and not more than 300k. Latest salary statement EAEC form or pay slip. Lembaga Hasil Dalam Negeri MalaysiaInland Revenue Board Of Malaysia.

Individual who has income which is taxable.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Register Tax For Newly Incorporated Sdn Bhd Yau Co

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Tax Guide What Is And How To Submit Borang E Form E

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

E Filing File Your Malaysia Income Tax Online Imoney

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

E Filing File Your Malaysia Income Tax Online Imoney

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

E Filing File Your Malaysia Income Tax Online Imoney

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To File Income Tax Manually Online E Filing In Malaysia 2022